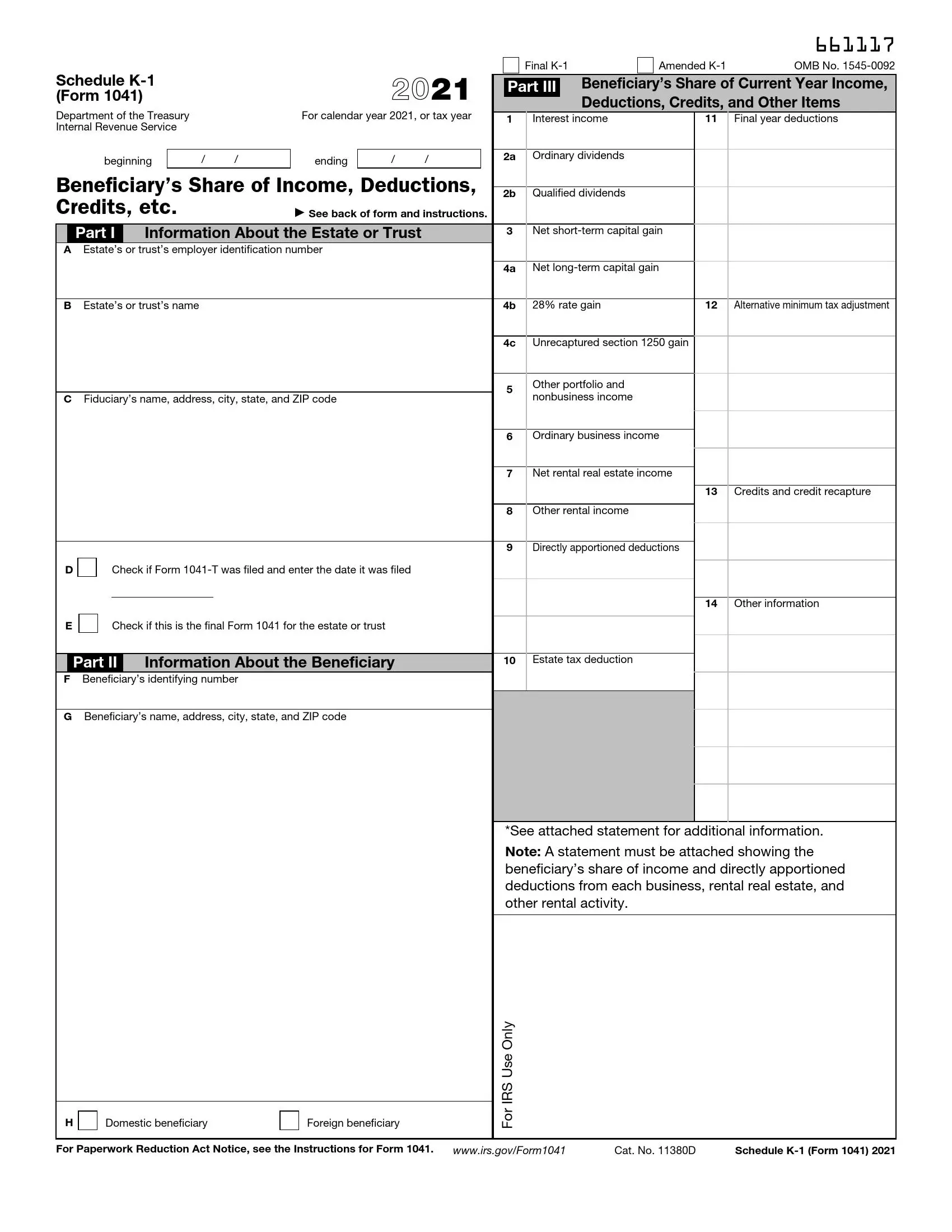

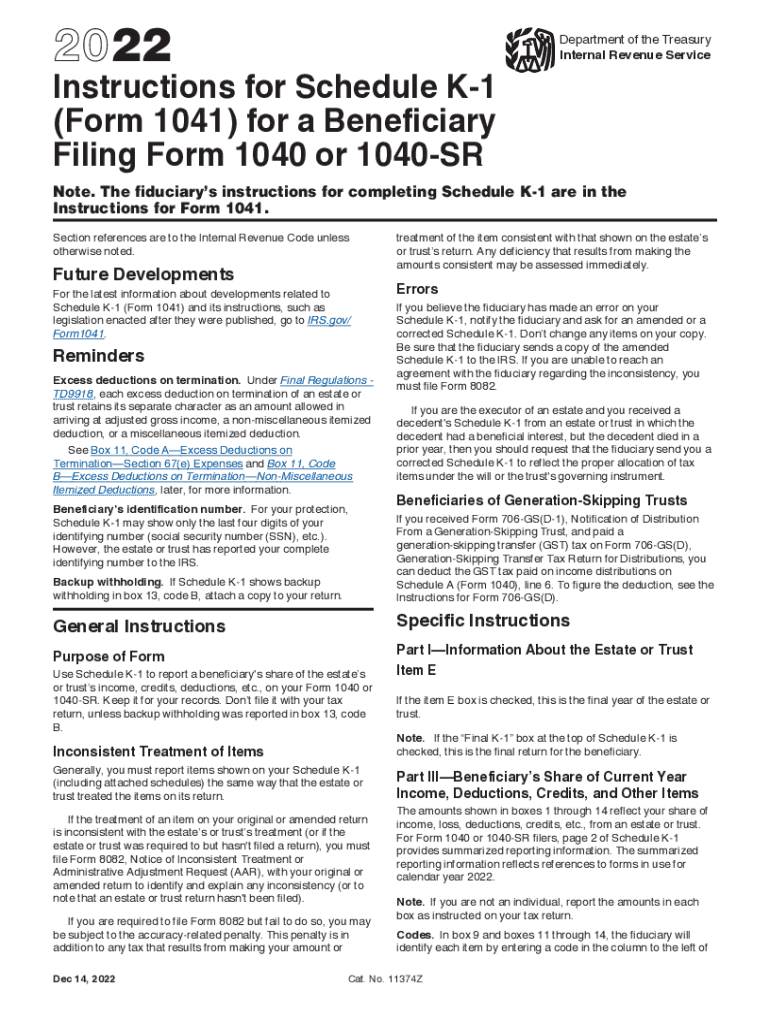

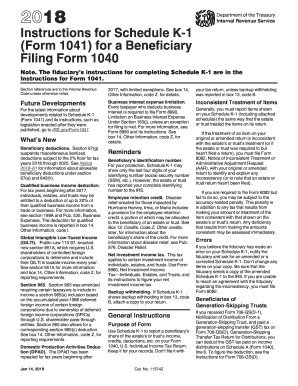

Irs Form 1041 Schedule K-1 2024 Instructions – Inheriting property or other assets typically involves filing the appropriate tax forms with the IRS. Schedule K-1 (Form 1041) is used to report a beneficiary’s share of an estate or trust . The Internal Revenue Service (IRS) has announced updates to the Schedule 2 tax form and instructions for the upcoming tax years of 2023 and 2024. TRAVERSE CITY, MI, US, January 13, 2024 .

Irs Form 1041 Schedule K-1 2024 Instructions

Source : www.irs.govIRS Instructions 1041 Schedule K 1 2022 2024 Fill and Sign

Source : www.uslegalforms.com2023 Instructions for Schedule I (Form 1041)

Source : www.irs.govSchedule k 1: Fill out & sign online | DocHub

Source : www.dochub.comIRS Schedule K 1 Form 1041 ≡ Fill Out Printable PDF Forms Online

Source : formspal.comK1 instructions filling: Fill out & sign online | DocHub

Source : www.dochub.comWhat is a Schedule K 1 Tax Form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.comSchedule 1 2022: Fill out & sign online | DocHub

Source : www.dochub.com3.0.101 Schedule K 1 Processing | Internal Revenue Service

Source : www.irs.govCan I File a K 1 on My Return 2018 2024 Form Fill Out and Sign

Source : www.signnow.comIrs Form 1041 Schedule K-1 2024 Instructions 2023 Instructions for Schedule K 1 (Form 1041) for a Beneficiary : Even though we’re well into February, it’s still possible that you might not have your W-2 yet. Here’s what to do. . The return prescribed by the Secretary for the reporting of a trust’s taxable income is IRS Form 1041, and the Schedule K-1 is made a part of that return. The instructions promulgated by the IRS .

]]>